REPORT

Consumer Trends in the Media Industry

We analyzed millions of social data points relating to media and entertainment to find out how consumers are discussing the sector.

Originally Published by Brandwatch.com

It’s been over two years since the pandemic began, and the world is in a very different place. Consumer confidence has been shaky since the beginning, from saving money back in 2020 to spending recovering in 2021. While some consumers may be feeling a little better than they were in 2020 financially, their insecurities haven’t entirely disappeared. With the cost of living going up worldwide, people are yet again becoming cost-conscious, especially when it comes to paying for “extras” like streaming and subscription services that kept many occupied during the long months of lockdowns.

We looked into what’s changed in how consumers talked about their spending relating to media and entertainment in 2022 and whether the rising cost of living has played a hand in it.

The impact of the cost of living crisis

- How is rising inflation affecting our ability to enjoy entertainment?

- Subscription cancelations

- Binge-watching and money-saving?

Print media: Are print subscriptions dying?

TV networks and movie production

- Boycotting media outlets

- How are people talking about going to the movies?

- What do consumers enjoy most about television?

Below we’ll expand more on each of these topics. You can also jump directly to each section by tapping the above links.

The impact of the cost of living crisis

How has the conversation around the cost of living changed in the last two years?

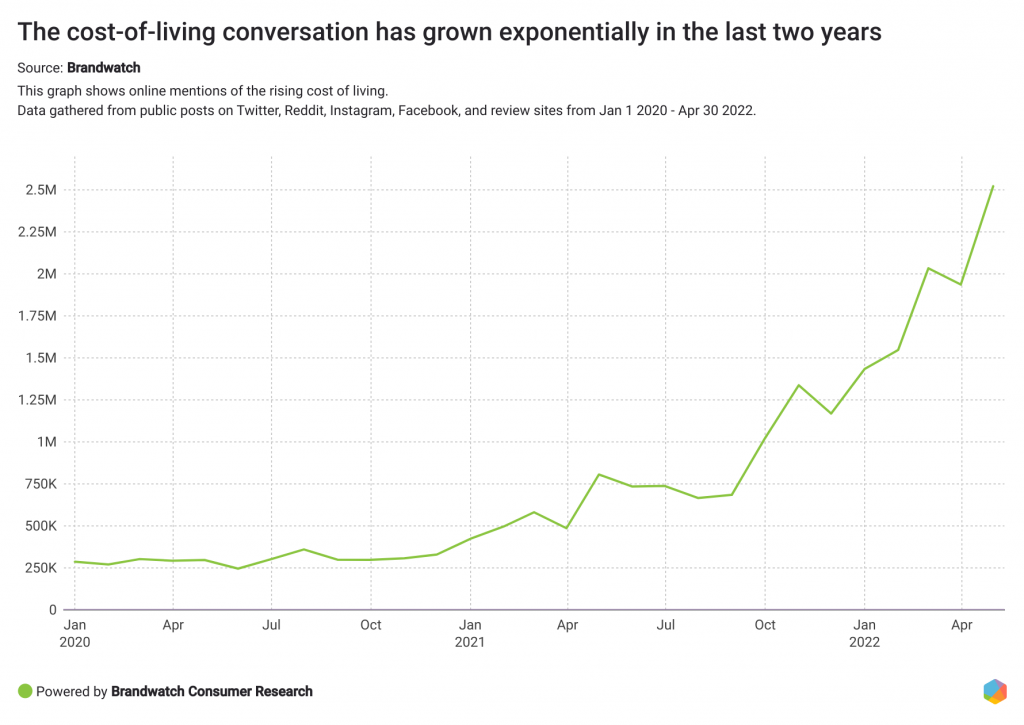

Our research showed a strong upward trend in mentions, illustrating a growing conversation around the topic.

We looked into mentions between November 1 2021 and May 1 2022, and the number of mentions containing ‘cost of living’ reached 16.86m, an increase of 228% compared to the previous period. Meanwhile, over 5m unique authors discussed the climbing costs of living (120% more when compared to the previous six-month period).

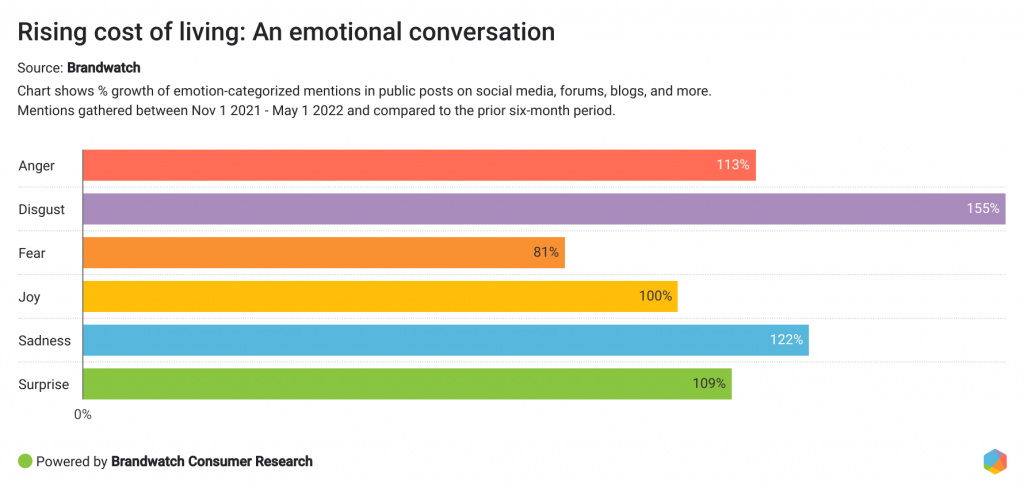

We also looked into how consumers emoted in conversations about the cost of living. Looking at the chart below, it’s clear that the issue has caused a variety of emotions in consumers, with sadness and anger dominating the conversation and the emotion of disgust growing exponentially (up 155% when compared to the previous six-month period we studied).

Unexpectedly, joyful emotions seemed to be on the rise too, and we couldn’t ignore it. It turns out some consumers have tried to look on the bright side of things, like the author below who, among other reasons, talking about how the cost of living in some areas was countered by the fact that people aren’t so restricted by location anymore.

This argument makes zero sense. So they leave a blue state to move to a blue city? What is the reason for leaving the blue state then? You are trying to make this fit your narrative without accepting the issues of the place they are leaving.

— Caleb McCandless (@CalebMcCan) February 13, 2022

How is rising inflation affecting our ability to enjoy entertainment?

Subscription cancelations

In one of our recent Brandwatch Bulletins, we talked about a growing conversation around subscription cancelations.

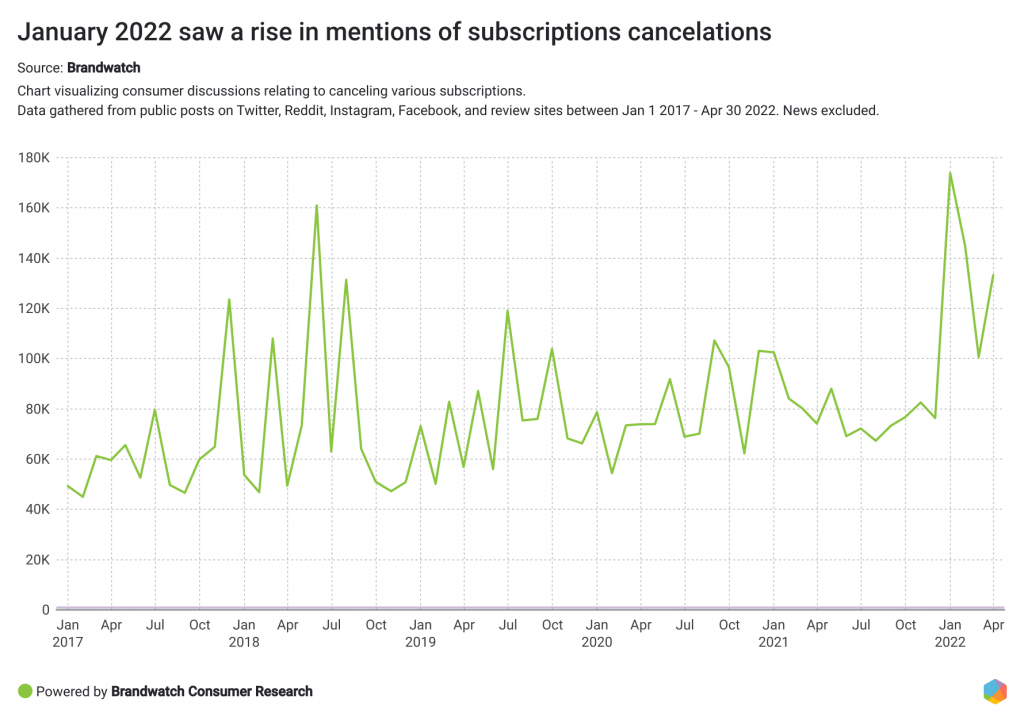

With the help of Brandwatch Consumer Research, we found that while there might be a seasonal pattern affecting the subscription cancelation conversation (you can see spikes in late spring and summertime), there was a significant increase in the volume of mentions in January 2022.

Unexpectedly, joyful emotions seemed to be on the rise too, and we couldn’t ignore it. It turns out some consumers have tried to look on the bright side of things, like the author below who, among other reasons, talking about how the cost of living in some areas was countered by the fact that people aren’t so restricted by location anymore.

Streaming was invented bc people didn’t like ads and cable was too expensive. Now streaming is more expensive than cable and almost every service has ads lmao! https://t.co/CB3c5e0XFL

— Terry Bruge-Hiplo (@DylanDubz_) April 20, 2022

How long until we sit back and calculate all the streaming services we signed up for is more expensive than the cable we cut?

— GreekFire23 (@GreekFire23) April 20, 2022

Politics is so depressing. Just let me enjoy my escapist TV via overpriced streaming services.

— Thugnificent’s Story Arc (@jewelnotjule) April 24, 2022

Another interesting discovery from our research on streaming is the ever-present influence of K-pop on every sector, or rather, K-pop fans who obsessively encouraged others to continue streaming to make sure their idols secure top places in the charts.

DONT STOP STREAMING EVEN IF WE’RE DOING GOOD LETS SET AN OUTRAGEOUS RECORD TO PROVE HOW MUCH WE’VE BEEN UNDERESTIMATED LETS GIVE THEM PROOFS 🧈 #STREAMBUTTERPARTY pic.twitter.com/1hf7EG0CGP

— Viv⁷ 💫 (@jeonjkoclock) May 21, 2021

And if and when the cost of streaming posed a barrier to achieving a common goal, many fans engaged in streaming parties and all sorts of collaborations to help lift those costs.

DONATE HERE:

— Stay Voting Zone 🎪 (@StayVotingZone) May 25, 2021

Funds will be used to buy streaming passes for STAYs who can't afford it but are willing to stream.@Stray_Kids #StrayKids #스트레이키즈 https://t.co/qkcgbBiC5K

I'm the type of fan who likes to streams consistently and voting in large numbers during cb period. I do like challenge sooo much and voting is very challenging that can set my self on fire.

— pipi yuno | exam month📚 (@yunhoyeah) September 29, 2021

📣STREAM TEAM RECRUITMENT📣

— KONSQUAD - Voting & Streaming (@kon_squad) May 23, 2021

Are you available to stream as of

May 28th on Korean platforms?

Can't afford your own streaming pass?

Then join our stream team!

Sign up here!

📝https://t.co/ZmjXCQPJ5t

❕Dates are still to be confirmed by Mnet#iKON #아이콘 @YG_iKONIC pic.twitter.com/0oh4kVyKXp

Are we still binge-watching?

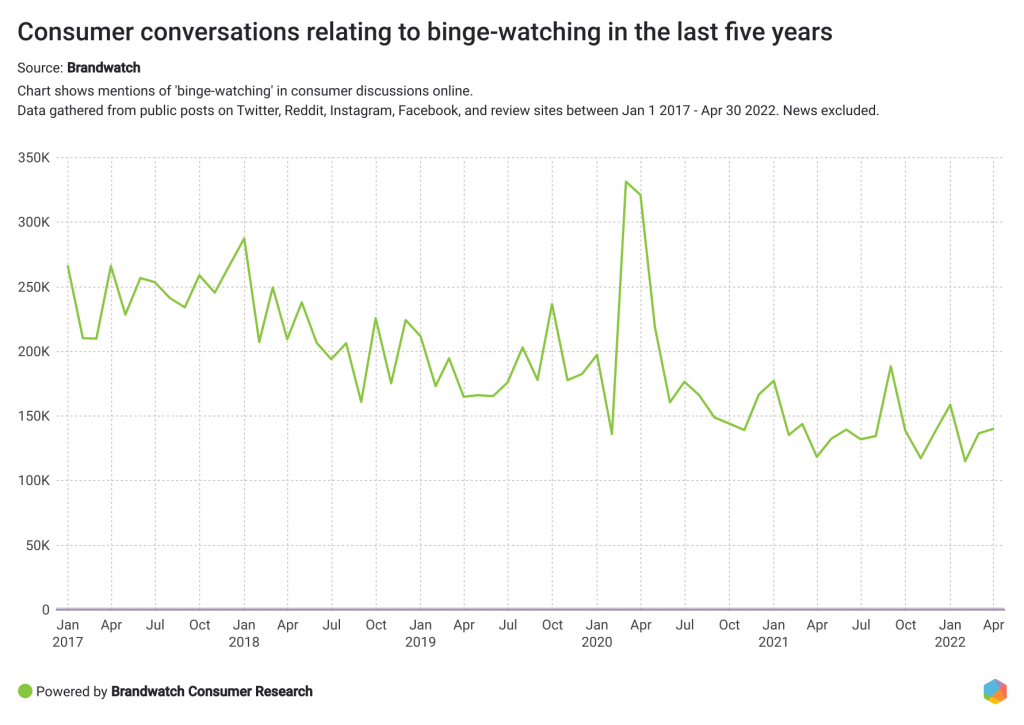

We created a query to track mentions of “binge-watching” in conversations and, according to Brandwatch data, there has been a steady decrease in mention volume over time starting in January 2021.

There were a few exceptions, of course. Several tweets on behalf of BTS were a huge talking point for fans, contributing to the peak in mentions seen on the chart in March 2020 with the below tweet boldly stating: “Binge-watch mood is ON.”

The compilation you shouldn't miss. 🎬

— BT21 (@BT21_) March 17, 2020

With BTS' drawing the vision to BT21 in full ANIMATION swing, watch some never-before-seen footage and teasers of the next chapter right now!

Binge-watch mood is ON. 😉

> https://t.co/WMht60nbpe#BT21_UNIVERSE #Official #recap #BT21 pic.twitter.com/YqUmNWeBpe

This peak in mention volume also happened a week before COVID-19 was declared a pandemic worldwide – when the news fatigue was catching up with consumers.

I can’t watch the news anymore.

— Nina (@ninampls) March 3, 2020

I need a mental health break.

What are you binge watching?#Netflix #Hulu #HBO #bingelist #Break

While overall, ‘binge-watching’ is mentioned in conversations less and less, that doesn’t necessarily mean consumers are shifting away from TV.

With gloomy economic forecasts, many consumers are looking to save their money where they can, like sharing passwords. This activity that reportedly costs streaming services over $2 billion in annual lost revenue. Keeping in mind the money-saving mindset of consumers and the ongoing decrease in binge-watching, subscription services brands will need to get creative to keep winning in the fight for customers.

Print media: Are print subscriptions dying?

Let’s switch gears and start by quoting one Twitter author:

“I ate lunch while reading a newspaper. This shocked my Grade 6 class. “It’s like you’ve never seen a newspaper before,” I said. “That’s because we haven’t,” one of the students replied.”

According to Statista, the average audience of magazine brands (print and digital) in the United States decreased from 691.5m in December 2019 to 642.6m in December 2020. And globally, print subscription revenue is projected to decrease by 2.99% by 2026.

It’s no secret that digital media has been taking over in the last 10 years. But is it too soon to wave goodbye to print newspapers and magazines?

We used Brandwatch Consumer Research to explore posts and conversations where consumers said they buy/order/read/subscribe/pay for newspapers and/or magazines. Looking at 22k mentions relating to consuming print media, we found a number of trends that point to the shifting relationship people have with printed news.

1. Trust

We saw a pattern of distrust in the media shared by many users who mentioned falling out with their favorite, trusted media brands due to a shift in how those media brands convey information.

Just had sobering conversation w one of the smartest young people I know and we both admitted we stopped reading almost every cultural magazine / outlet we used to be devoted to because they've become so propagandistic. (And I feel this while on the Left -- how do others feel?)

— Anna Gát 🧭 (@TheAnnaGat) January 26, 2022

I wish there was a single newspaper I could read that just delivered the news without an agenda

— Jenin Younes (@Leftylockdowns1) March 13, 2022

2. Value

Value was a big one among consumers, as some of them no longer saw value in traditional media such as newspapers and preferred social media instead.

Media sellouts are triggered because IK doesn't read newspapers anymore. I don't blame him as none of them provide any value. Social media is where I get all my news from as well.

— Shoaib Taimur (@shobz) April 21, 2022

Remember the old days before free social media when we had to buy newspaper ads to publicly announce our courage, thoughtfulness, virtue and nobility? It’s so much easier now!

— Pat Sajak (@patsajak) January 6, 2022

3. Options

Consumers underlined how they choose what and where they consume media and news and newspapers were frequently out of favor in those conversations.

I don't read magazines anymore. I read blogs.

— John | Simplified Profits 📩 💰 (@youmetjohn) March 4, 2022

I don't watch TV anymore. I watch Skillshare.

I don't listen to the radio anymore. I listen to podcasts.

I don't go to the movies anymore. I listen to TED talks.

Reason I subscribe to Apple News is for $15 a month I can read newspapers and magazines the world over and that means I can read many different journalists and commentators. Labor will win the SA election. That’s a certainty.

— Rick (@colonelhogans) March 7, 2022

The ode to print magazines

Defying the odds, and unlike other print media, print magazines proved pretty unshakable in the changing media environment.

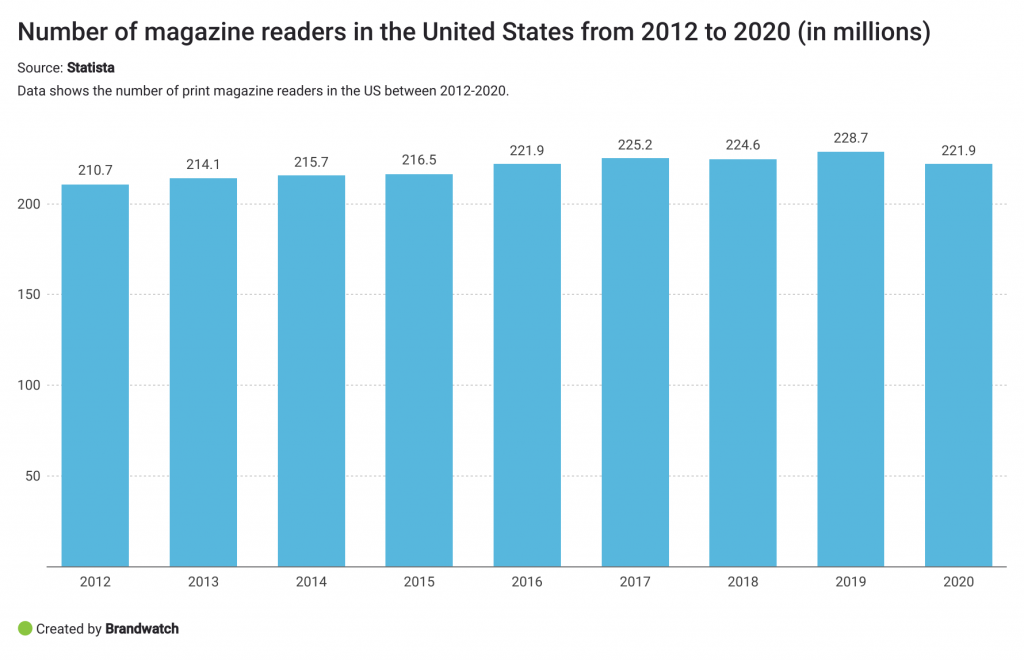

According to this Statista report, in 2020, there were 221.9 million magazine readers aged 18 or older in the United States. This marked a decrease of over six million readers since the previous year. On the other hand, the figure for 2019 was the highest recorded since 2012, and trends during that period indicated a gradual annual increase in the number of magazine readers.

Why did readers say they do buy print media?

With this question in mind, we turned to Brandwatch Consumer Research.

Besides the obvious reasons like habits (eg, grew up watching family read newspapers daily) and some audience members looking for niche topics like science and medicine, there were a few that stood out.

Some consumers would buy a magazine for its inspiring cover that could make a collector’s item – something for publishers to consider.

I don't buy magazines but I seen this today and had to buy . I love princess Diana beautiful soul 🙂🙂 @FourtyNegative pic.twitter.com/duXm3AxkiP

— Lisa G711🗣🗣 (@G711Lisa) November 22, 2021

I don’t usually buy People Magazine, but the Sidney Poitier cover story made it a collector’s item for me: “How One Actor Changed the World” pic.twitter.com/W6JHoL6juH

— Kenny BooYah! 🖖🏾 (@KwikWarren) January 15, 2022

Supporting favorite artists was another big reason for consumers, especially K-pop fans, who were very vocal on social, encouraging others to buy magazines featuring their idols.

It’s evident that with a growing number of ways to consume media and news, consumer interest in print media has started to shift, and brands that want to stay afloat might need to explore other avenues to deliver the news and secure the audience.

Some traditional media brands are already ahead of the curve, such as BBC News which recently launched on TikTok, calling for people to discover BBC news, headlines, and popular videos.

And now that we are at it, check out Brandwatch’s brand-new TikTok account as well!

TV networks and movie production

Rising living costs may not have been the only reason why some people turn away from consuming their favorite media. What else has got consumers enraged?

Boycotting media

Using Consumer Research, we tracked mentions of ‘boycott’ in conversations relating to television, channels, shows, and actors.

A lot of calls for boycotts in the recent two years were related to a spread of misinformation, like this example.

I think we should start boycotting some tv station ...... they keep spreading fake news ✊🏾✊🏾✊🏾

— Rudeboy (@rudeboypsquare) October 12, 2020

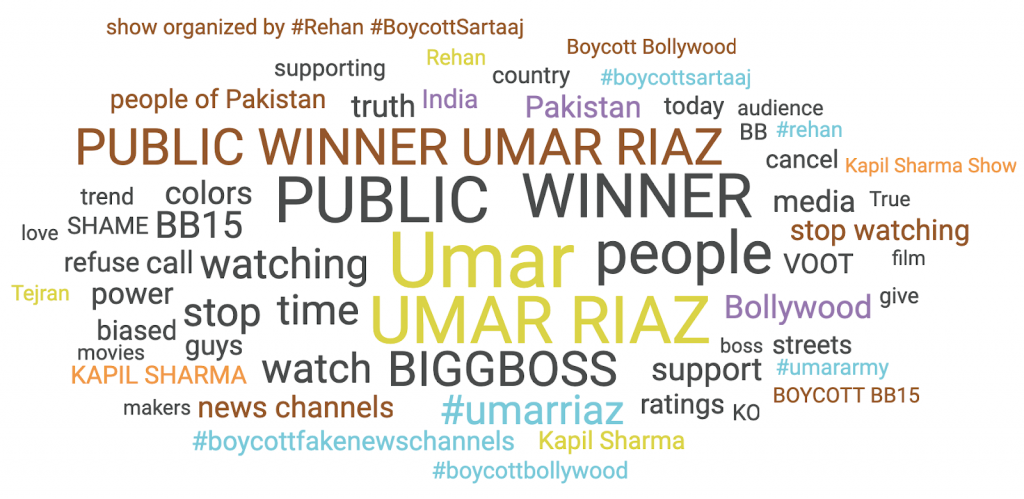

The word cloud below represents popular topics in consumer discussions around boycotting between November 1 2021 – April 31 2022. As you can see, Bollywood seemed to occupy the minds of many consumers.

Popular topics in consumer discussions around boycotting

This recent public outcry was focused on the Bigg Boss, a famous reality TV show in India, and one of its contestants getting kicked out despite being one of the viewers’ favorites. The fans of the show complained about both the producers and the broadcast network for promoting ‘biased judging’ and claiming that contestant Umar Riaz would’ve otherwise won by the public vote.

Why should media and entertainment businesses care about public calls for a boycott?

There are several reasons, and TV ratings are probably the biggest one of all. According to this article, the makers of the 15th season of the Bigg Boss show, while “constantly trying to bring in new tasks and contestants to raise its TRPs” (television rating points), have failed to please the audience, scoring the lowest recorded TRP in the last 12 years.

How are people talking about going to the movies?

Our recent Consumer Trends report covered how consumers discussed their life post-pandemic and whether they were ready to go out – and spend money. Elevated expectations around what that experience should look like was one of the main trends seen in our research.

So, how are consumers discussing the film industry now? Let’s just say there’s plenty to complain about.

1. “Stop supporting Hollyweird”

In the free market, consumers are free to choose what they’d like to watch and whom they’d like to support – vocally and financially. There is plenty to complain about in the movie industry, with many calling out bad behavior.

That Will Smith incident was brought up in this context.

As reprehensible as Will Smith actions were, we as a society actually support that crap by going to their shit movies...

— The D Man 🇺🇸 (@dstedham511) March 28, 2022

STOP SUPPORTING HOLLYWEIRD

Will Smith was given an Oscar because they saw how aggressive & unhinged he gets over nothing. I’d never watch any of his or his family movies. I am going to stop watching the Oscars too. Will Smith should have been removed from the theatre.

— La Camrey (@LaGasparin) March 28, 2022

2. Calling out content that shames people

Earlier this year, Ditch the Label published an article that talks about shame and how it can negatively impact our well-being and self-esteem. Sexuality is one of the topics that gets shamed most often in the media, and especially when the messages of shame are related to gender.

Many consumers voiced their disagreement with the messages they saw projected on screens, calling for kindness and to remove taboos and social judgement from content.

When the fuck are shows, movies, and characters going to STOP acting like it is so fucking abnormal / weird / wrong to be a virgin at any age?! Or just not be into sex?! Ya know what sex gets u? Unwanted pregnancies, STDs, and a shit ton of emotional baggage! #thegooddoctor

— TV Addict (@TVAddict617) March 29, 2022

The film industry: Lessons from consumers

We put together a search query around the top seven movie production brands, and here’s what we’ve learned from analyzing those social conversations:

Consumers hate when:

- Poor editing takes away from the experience.

Great example of how poor editing and constant rapid cuts can make two legends of martial arts film look clumsy and slow. https://t.co/ttySyaueS8

— Grant the truculent space bumpkin (@grantthethief) May 15, 2022

- Production studios don’t do the right thing.

Fans actively voiced their opinions on industry matters, demanding that production studios do what’s perceived to be the right thing.

Warner Brothers is known to be a directors studio right?

— Leonidas (@Signs2323) August 13, 2021

Don’t let this man be shamed for years from a version of a film you released, that was butchered up because of your reactionary mismanagement.

Do what’s right! #ReleaseTheAyerCut pic.twitter.com/T8mQ771qdv

- When production studios turn everything into “reality” shows.

“Please rethink your strategy!” a consumer shared on Twitter.

So many new shows are poor copies of shows from the past, while #Debris was fresh and interesting. We are tired of “reality” shows or police/law/medical shows. Please rethink your strategy! #SaveDebris @peacockTV @kellycampbell @nbc @warnerbros @ViacomCBS pic.twitter.com/1wLWaiDkxR

— Dr. View (@TVasTherapy) October 14, 2021

Many consumers expressed that they were getting bored with the existing selection of shows, with some labeling what they watched as “dry,” “generic,” “lame,” and a “copycat.”

Imagine having the means to create ANYTHING you can conceive, any universe, tell any story with the budget of Warner Bros but instead pump out this lazy, generic copycat bullshit by choice. pic.twitter.com/7UXroAE68v

— 𝟖 𝐁 𝐈 𝐓 𝐙 𝐎 𝐄 (@8bitZoe) March 15, 2022

Consumers are looking for new and interesting shows, fresh faces, and story plots to keep them watching. And if the film industry takes too long to address this need, they’ll risk losing their audience to other means of entertainment.

This Twitter user put it best:

“Can dreamworks give us more she ra content so we can have something new to talk about pls I’m sick of crying over the same takes everyday give me something fresh to sob about.”

The TV network industry: Lessons from consumers

We also tracked mentions relating to the top 14 TV networks between November 1 2021-May 1 2022. What sparked joy, what were consumer pain points, and what can brands take away from our analysis?

Consumer pain points relating to the TV networks

1. Lack of flexibility with the existing TV bundle offerings

This topic cloud represents consumer conversation between November 1 2021 and May 1 2022. The largest topic on the word cloud, ‘Fox’ or Fox News, was seen as one of the biggest topics in discussions relating to the top TV networks, with some consumers questioning their limited ability to manage their cable service bundle.

Am I alone, or would you DROP Fox "News" in a second if your cable provider let you?

— Jo 🌻 (@JoJoFromJerz) April 4, 2022

2. We need hopeful news

Over two years since the beginning of the pandemic, and with the current economic and political climate, consumers are longing for feel-good media. And to confirm this, one of the recent NY Times articles came out with a bold headline, “The News Is Making People Anxious.” The consumer below expresses exactly that in a tweet: “Lord have mercy, I’m tired of all the negative news…”

#MondayMotivation Lord have mercy, I'm tired of all the negative news. @ABC or somebody ought to focus on something positive as we approach the holidays, like how @HyVee donated food to a church in Minneapolis so they could hand out 250 #Thanksgiving baskets to families in need! pic.twitter.com/t5tJCABOzf

— Sheletta Brundidge (@ShelettaIsFunny) November 22, 2021

3. Unrealistic expectations and scenarios drive viewers away

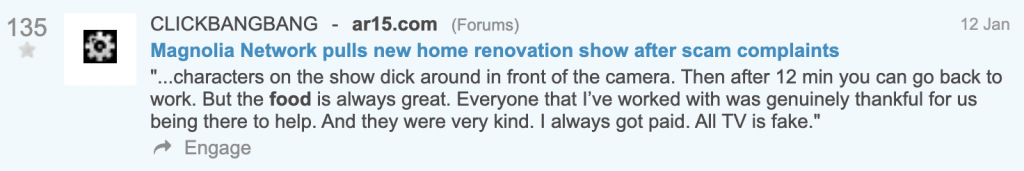

Too much staging and fake content can become a huge turn-off for consumers, impacting ratings, reputation, viewership – and ultimately, revenue.

It’s especially frustrating for consumers looking for inspiration from the home improvement shows they fell for during lockdowns. We’ve covered consumers’ newfound love for DIY in our recent Retail Guide.

As one consumer anonymously put it on a forum: “All those home shows give people unrealistic expectations. “Oh, that’s going to be very cheap and easy, and fun!” Let’s do the same thing to our house and expect to pay the same as it costs down in Toad Holler, Mississippi.”

For the reference, last year Mississippi made it to the top of the list of the most affordable states in the US.

Another user echoed this sentiment.

“Lord have mercy, I’m tired of all the negative news…”

What did consumers say they enjoy about television?

1. Feel-good stories are highly regarded by consumers

Consumers spoke favorably about media content (and channels) that highlight feel-good stories. In this tweet specifically, a consumer talked about a food show run on PBS, a free network that’s available for everyone.

I love how he picked PBS, which is accessible to everyone. How he chose food which unites people. How he’s highlighting family owned restaurants. He looks so happy and the people interacting with him as well.

— ✨🌙💫Kat’s Diary💫🌙✨ (@WritingFantasy_) November 10, 2021

2. Who doesn’t like feeling inspired?

This user mentioned both Food Network and HGTV in a positive context while sharing images of homemade meals, likely inspired by the media broadcasted by one of these networks.

From now on, gonna tuck my fitness progress after my cooking & sewing clips

— AbeyantHero @ YouTube ➕ Twitch (@AbeyantHero) April 18, 2022

If you don't 💕 me at my Food Network/HGTV mode, you don't deserve me at my 👕 🚫 fit progress pic.twitter.com/Y0fcCaSVUw

3. Consumers seek comfort in the familiar (especially in these anxious times during a global crisis).

just binge watching Tripple D! love the update Food Network Go and HGTV Go did, its awesome! i can finally stream shows i havent watched in such a long time! 🥳🥳

— Tracy Sharpe (@tsharpe319) January 23, 2022

At a time of uncertainty, many people are craving stability and comfort. Television provider brands that are on top of monitoring consumer conversations and sentiment have a better shot at delighting their viewers and securing their future business.

The final word

The increase in the number of channels for entertainment in recent years has led to a surplus of options for consumers. Brands that are in the media and entertainment space need to listen to consumer needs closely in order to retain customers and attract new audiences.

Case Studies

Here are some practical examples of how companies use Brandwatch for day to day community management.